“银行信用扩张驱动了商业周期的所有阶段:以货币供应扩张和不良投资为特征的,膨胀的繁荣时期;危机在信用扩张停止时到来,让不良投资得以暴露;以及萧条式的恢复,这一必需的调整过程让经济回到最有效率的方式来满足消费者的需求。”

---Murray Rothbard 《美国大萧条》

"Thus, bank credit expansion sets into motion the business cycle in all its phases: the inflationary boom, marked by expansion of the money supply and by malinvestment; the crisis, which arrives when credit expansion ceases and malinvestments become evident; and the depression recovery, the necessary adjustment process by which the economy returns to the most efficient ways of satisfying consumer desires. "

---Murray Rothbard 《America's Great Depression》

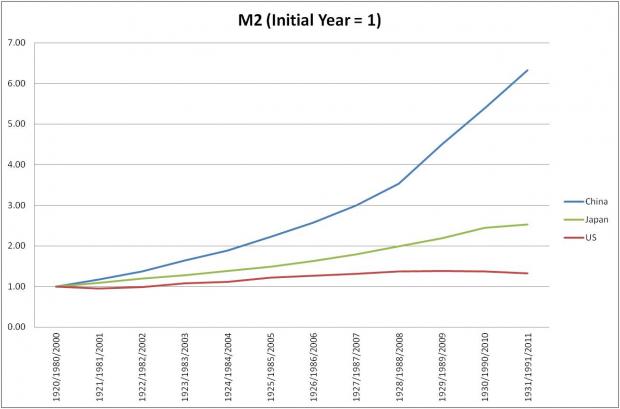

M2的变化。红线为美国,起始年份(1920)为1。绿线为日本,起始年份(1980)为1。蓝线为中国,起始年份(2000)为1。

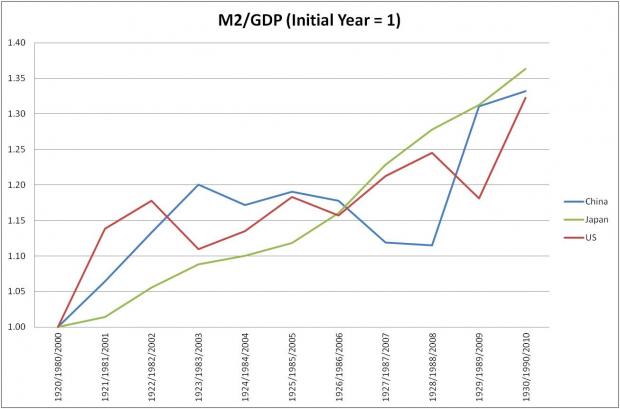

M2与GDP的比值变化。红线为美国,起始年份(1920)为1。绿线为日本,起始年份(1980)为1。蓝线为中国,起始年份(2000)为1。图中可见四万亿的作用。

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号